Strategy

Bouwinvest invests globally in metropolitan areas in ten countries and in six sectors. This strategy enables Bouwinvest to derive the maximum benefit from trends and developments, such as population growth, urbanisation and globalisation. What is more, this international approach ensures that Bouwinvest can benefit from various economic cycles in the fastest-growing real estate markets. Given these trends, Bouwinvest expects to increase its invested capital to € 15 billion and its workforce to 200 FTEs in 2021.

Although the world is globalising, we see real estate as a local business and believe long-term cooperation is essential to finding and making the right acquisitions. This is why we have decided to open an office in Sydney and why we are planning to open an office in New York. We expect this to enable us to seize opportunities more quickly and to work more closely with our local network. In the Netherlands, Bouwinvest manages its own real estate portfolios; we work in close cooperation with our Dutch partners and we play an active role in a number of real estate sector platforms.

Market proposition

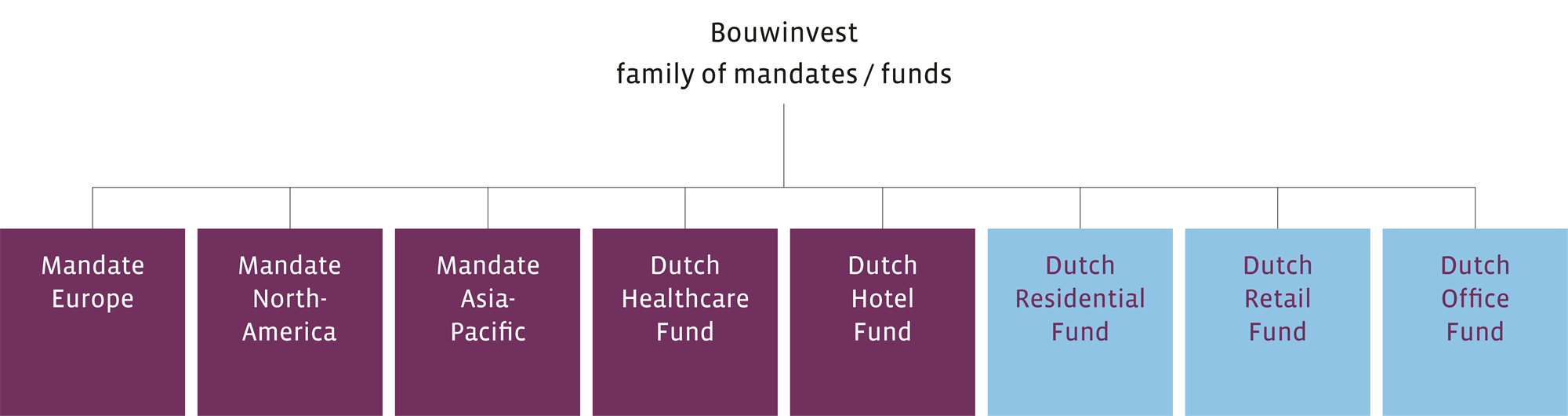

Bouwinvest manages three international mandates and five Dutch sector funds. Three of the funds – Residential, Retail and Office – are open to investors. We currently have 22 clients that have invested in our funds. We manage the other funds and the mandates exclusively for bpfBOUW, the pension fund for the construction industry.

Client orientation

To make sure we execute our strategy correctly, Bouwinvest has made our clients our number one priority. Clients entrust their capital to Bouwinvest for the long term. It goes without saying that they expect us to provide top quality and all-inclusive service, which we believe requires proactive and transparent communications. The competition in our sector is also increasing and our (potential) clients can now choose from various parties. What this means is that ‘we need to say what we do and we need to do what we say’ - in terms of investment exposure, returns, risks, costs, sustainability and liquidity. This is partly why we want to continue to invest in close relationships with our clients and in outstanding proactive and transparent communications. We will look back and look forward and we will follow current affairs even more than we do right now. In 2018, we were faced with various geopolitical developments, such as growing trade wars, the Brexit turmoil and the collapse of retail chains. All these developments required us to act proactively by providing our clients with information in a timely fashion.

Material aspects

Bouwinvest considers the insights and expectations of the world around us as extremely important. This is why we are in constant dialogue with our stakeholders and why Bouwinvest works continuously on building and protecting our good reputation. In 2018, we conducted an analysis to chart the material aspects of our clients, local operators, tenants and employees. We then initiated a dialogue with these stakeholders on our (social) role and the aspects important to them that our organisation has an impact on. The better we perform on these aspects, the more value we create for society and our stakeholders. We discuss each aspect in more detail below and you will find a detailed materiality matrix in the addenda to this annual report.

Integrity and transparency

Trust is crucial for Bouwinvest, if we are to continue to attract investors, such as pension funds and other institutional investors, for our real estate funds. This is why we see integrity, honesty and transparency as major priorities. Bouwinvest’s management communicates openly on its decision-making and its financial and non-financial business performance, both via regular reporting channels and online. Bouwinvest adheres to international reporting standards, such as the Global Reporting Initiative (GRI).

We have an independent compliance team that identifies, assesses and monitors the company’s compliance risks and provides advice and reports on same to the Board of Directors. Our compliance team uses the Bouwinvest Compliance Cycle to plan, execute and report on all the relevant activities within the company.

Energy-efficient buildings

The built environment accounts for some 40% of the world’s energy consumption and as much as 30% of global CO2 emissions. Energy-efficient buildings have a major impact on the fight to reduce energy use and consequently on the reduction of global CO2 emissions. This is how Bouwinvest contributes to the fight against climate change and compliance with the Paris climate agreement (COP21).

Energy-efficient buildings tend to have lower (service) costs, provide greater levels of comfort and have higher occupancy rates. This helps them to retain their value and be better prepared for any future tightening of laws and regulations as a result of climate agreements and the like. We are building an energy-efficient real estate portfolio by investing in buildings with a well-insulated shell construction and the subsequent application of state-of-the-art heating, cooling and lighting systems and systems aimed at generating sustainable energy.

Energy labels and the measurement of actual energy consumption per square metre (energy intensity) are two of the methods we use to realise an energy-efficient portfolio. Our target was to have a Dutch portfolio with 100% green energy labels (A, B or C) by the end of 2018 and to reduce the energy use of our entire portfolio by 2% per year.

Limiting CO2 emissions in the real estate portfolio

The climate is changing due to the fact the earth’s temperature is rising. This is because more and more greenhouse gases such as CO2 are being emitted into the earth’s atmosphere. Real estate accounts for a significant share of these greenhouse gases. As an investor in buildings, we consider it our responsibility to make a contribution to the fight against climate change.

We want to contribute to this fight by reducing our use of energy and materials to the minimum, by investing in well-insulated buildings, by generating sustainable energy in and around our buildings and by building a fossil-free real estate portfolio. We have set ourselves long-term targets for 2030 and 2045. Sustainable building certificates give us the data we need for the next steps in this process. We are reducing our direct emissions (gas), we are ‘greenifying’ the electricity we use and opting for sustainable energy sources, such as solar panels, heat pumps and thermal energy storage systems. Up to the end of 2018, our target was to reduce the CO2 emissions of our real estate funds by 2% per year.

Satisfied tenants and users

The satisfaction of the tenants and users of the buildings in our portfolio is a good indicator of whether those buildings and the related services we offer are meeting expectations. We listen to our tenants to learn more about their wishes and requirements, now and in the future.

Surveys and tenant panels provide us with the insights we need on an annual basis. We use the results of these surveys and panels to improve our processes and products. We are convinced that satisfied tenants and users contribute to stable rental income and reduce the risk of vacancy. Bouwinvest targets an average tenant satisfaction score of at least 7.

Client-centric approach to investors

Maintaining the trust of institutional investors, such as pension funds, insurance firms and charitable organisations, is essential to Bouwinvest’s future growth. Clients entrust their capital to Bouwinvest for the long term. Bouwinvest assures its own continuity by serving the interests of our stakeholders.

Bouwinvest conducts regular client satisfaction surveys and targets an average client appreciation score of at least 7. For 2019 onwards, we have raised this target to 7.5.

Satisfied and engaged employees

Bouwinvest’s success depends very heavily on its employees. It is thanks to their dedication and commitment that we are able to record such outstanding results and meet our targets. Satisfied and engaged employees act as our ambassadors and are vital to the continuity of our organisation.

Bouwinvest wants all its employees to be satisfied and engaged and measures this every two years via a survey. We target an average satisfaction score of at least 7. For 2019 onwards, we have raised this target to 7.5.

Cybersecurity and privacy

Bouwinvest considers data security as strategically important. Clients and tenants can rest assured that their personal data is well protected. Bouwinvest recognises the dangers of cybercrime and has strict procedures in place to guarantee effective protection.

All of our critical operating processes are backed up by IT applications. Our Governance function treats IT data security as an integral part of the risk management process. One of the defined risks in the scheduled IT Risk Assessment is the threat of a cybersecurity attack. To mitigate this risk, we have designed a number of control measures and we carry out regular tests. Because we work with chain partners in the real estate sector, we conduct annual surveys at our chain partners to check the effective operation of their IT security related to Bouwinvest’s data. To measure our resilience on the cybersecurity front, in late 2018 we organised a ‘hacking attempt’ on Bouwinvest, which revealed that we are well secured. Our goal is to manage our data effectively and prevent any major incidents on the data privacy front.

Affordable rental homes

We consider the affordability of homes to be an important issue, as we have been investing in Dutch urban areas for 20 years or more. Liveable, affordable and inclusive cities offer a better guarantee for the attractiveness of an area and therefore the value retention of the buildings in that area. People want to live, work and stay in these areas now and will continue to do so in the future. This provides our clients with a long-term stable return on real estate. What is more, we are currently facing a major shortage of affordable (rental) homes. So on this front social interests coincide with the financial interests of our clients.

Bouwinvest want to provide sufficient affordable homes. This is why we specifically focus on the addition of mid-rental segment homes in the Netherlands.

New technology and innovation

Bouwinvest keeps a very close eye on new technological developments and we invest in innovative companies we consider relevant to our business operations. Examples include new technologies that make it possible to reduce the impact of buildings on the environment and improve peoples’ health. The same goes for artificial intelligence, smart technology, big data and predictive analyses, blockchain, process automation, digital communication platforms and innovations devised by new FinTech firms.

To stay abreast of new developments and new players that could help us to future-proof our investments and business operations, one of the targets we have set for this year is to join various knowledge platforms in the fields of real estate and innovation. We will run small-scale pilots of any new opportunities that emerge from these platforms and that are in line with our targets. If these pilots are successful, we will then ramp these up on a larger scale. Our CSR & innovation department will coordinate, stimulate and facilitate these efforts.

Safety in the construction process

The impact of our investments starts right at the beginning, in the construction process. Building sites have an impact on their immediate environment. We consider the safety, health and working conditions of construction workers and limiting the nuisance levels for the local environment to be very important.

This is why whenever possible we ensure that developers and construction firms apply the Dutch Considerate Builders (Bewuste Bouwers) code of conduct in the Netherlands. This code provides the entire construction team (from carpenters to project managers) with concrete guidance for working with consideration for the environment, safety and reducing nuisance to the minimum. We have set ourselves the target of having at least 50% of the building sites in which we invest (both new-build and redevelopment) registered under the Considerate Builders scheme by the construction companies involved.