Portfolio characteristics

Dutch residential properties (256 properties, 17,174 homes) valued at € 5.2 billion at year-end 2018

94.0% located in the Randstad, Brabantstad and mid-eastern conurbations and inner-city areas

90.2% in liberalised rental sector especially the mid-rental segment

Continuously high occupancy rate

98.0% green energy labels (A, B or C label)

GRESB 4-star rating

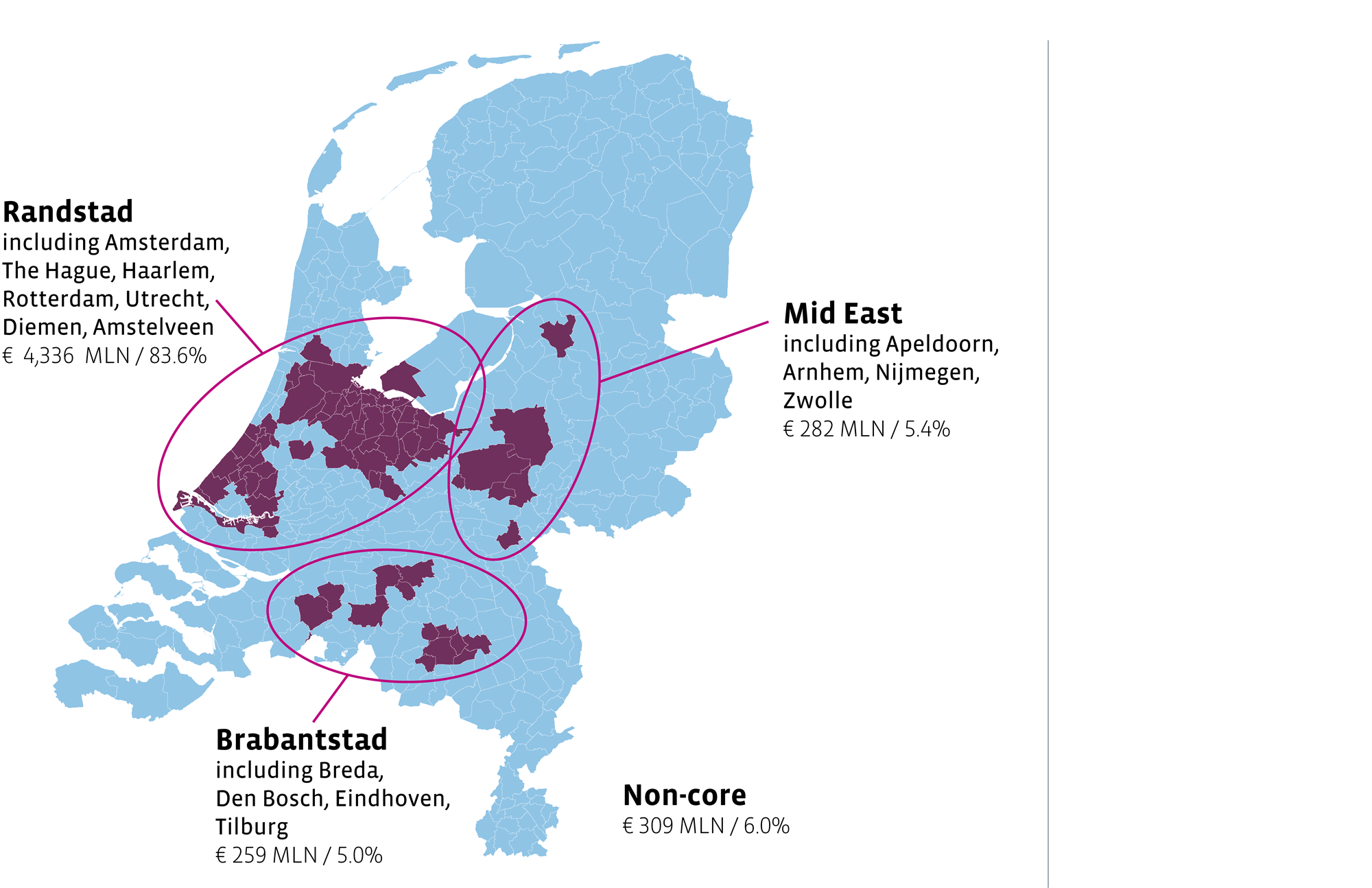

Core region policy

To identify the most attractive municipalities for residential investments, the Fund takes into account the following indicators:

The Fund’s plan is for at least 80% of the total portfolio value to be in investment properties in the Fund's core regions. This currently stands at close to 94%. As the entire investment pipeline is located in the Fund’s core regions, this percentage will increase slightly in the near future. Furthermore, the Fund has a guideline that a maximum of 90% can be invested in the Randstad conurbation. This now stands at 83.6%.

The Residential Fund's core regions based on market value, excluding property under construction

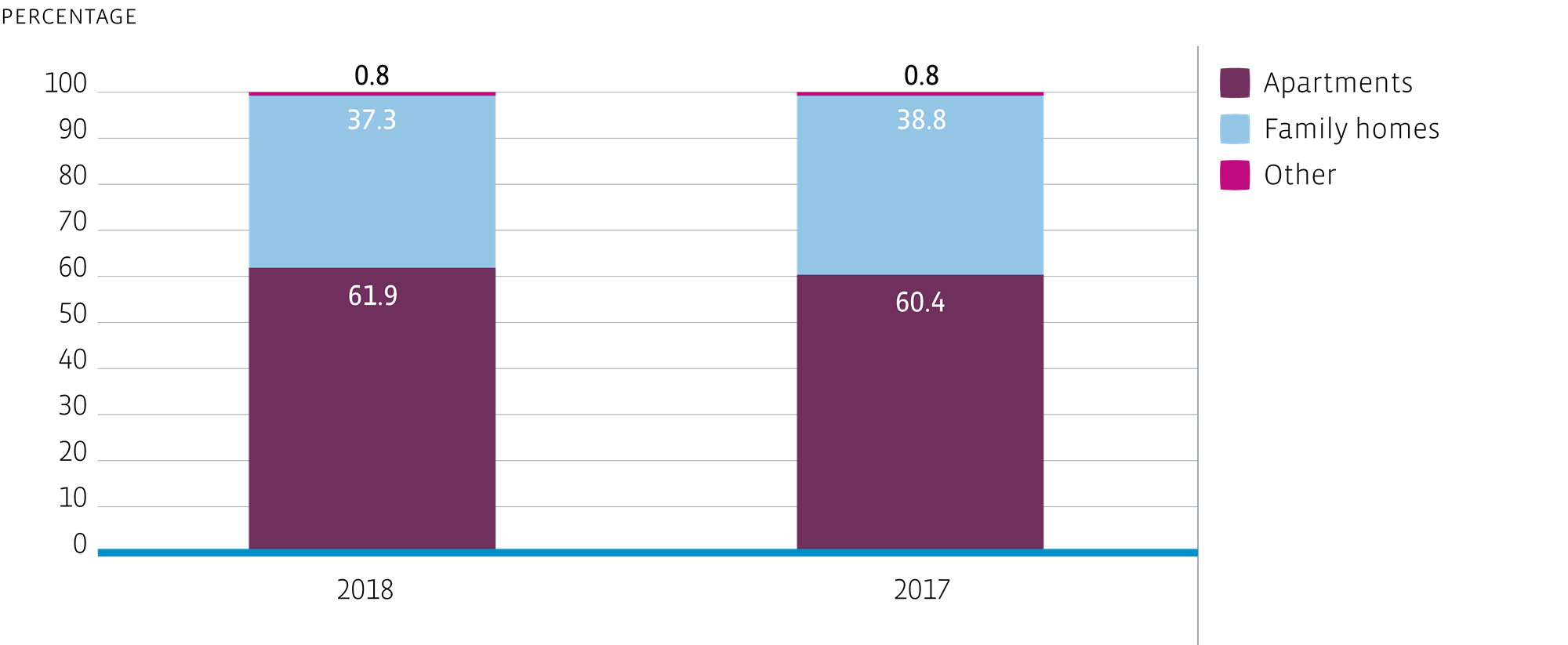

Major segments

To meet its own diversification guidelines, the Fund strives for a healthy balance of family homes and apartments. Due to our focus on urban areas, the proportion of apartments will continue to grow for the foreseeable future. In 2018, we expanded our diversification guidelines. One of these guidelines is that a minimum of 25% of the portfolio must consist of family homes.

Portfolio composition by type of property based on market value

In our drive to optimise our portfolio, we take into account the following diversification categories:

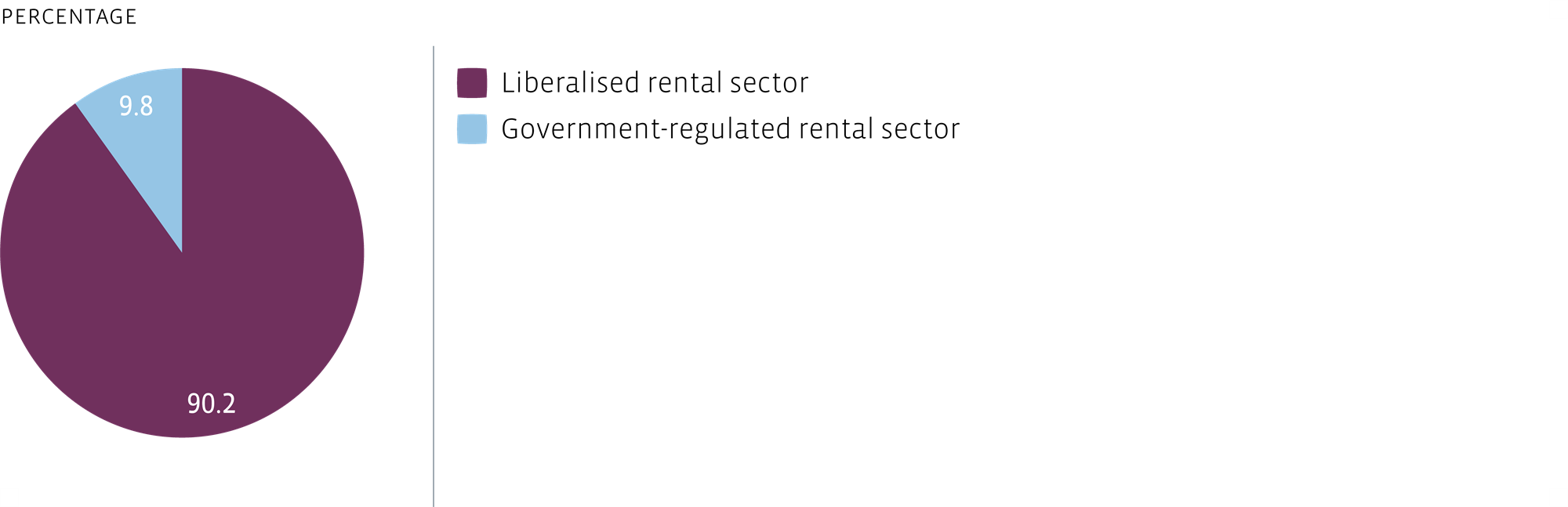

Focus on liberalised rental sector

The Fund sees the liberalised sector (rents of € 711 and above and as of 2019, € 720 and above) as particularly interesting, as demand is set to increase, while supply is lagging, especially in the Netherlands’ largest and most popular cities. With more than 40% of its properties in the mid-rental segment (€ 711 - € 1,000), the Fund’s focus continues to be on this segment. Demand is also growing due to the sharp house price increases in the owner-occupier market in recent years. While these house price increases are likely to be less marked over the next few years, high house prices will continue to deny a significant proportion of home-seekers access to the owner-occupier market. This will only increase demand for affordable mid-segment rental homes. In addition, an increasing number of local authorities have introduced or are planning to introduce measures to increase the construction of affordable homes, to ensure a ready supply of housing opportunities for low and middle income households. We believe the liberalised rental sector, with its high occupancy levels, will continue to be an attractive market for institutional investors. In our guidelines, we noted that a minimum of 75% of the portfolio must be in the liberalised segment. We now stand at 90.2%.

Portfolio composition by type of rent based on rental income

Selection of principal properties

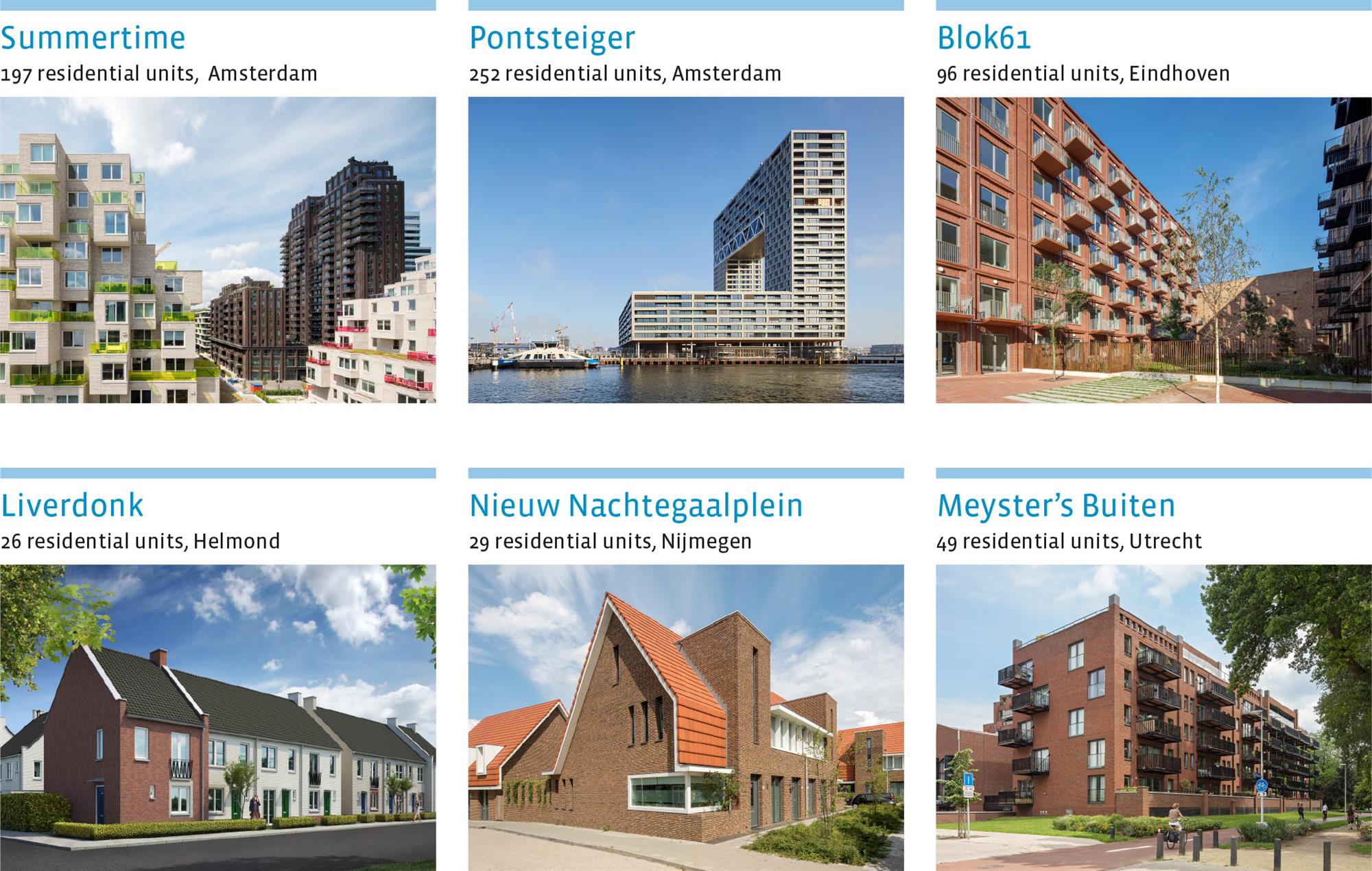

Existing portfolio (selection)

Portfolio pipeline (selection)

Added to the portfolio pipeline in 2018 (selection)